Absolutely! While a 556 credit score may not be considered excellent, there are still plenty of lending options available for you. The key is to do your research and shop around for lenders that specialize in working with borrowers with lower credit scores. You can also work on improving your credit score by paying bills on time and reducing debt to increase your lending options. Don’t let a lower credit score deter you from seeking out a loan – there are still opportunities available to you!

- How A Credit Score Affects Loan Eligibility

- Factors That Impact Loan Approval

- Minimum Credit Score Required for Loans

- Can You Qualify for a Loan with a 556 Credit Score?

- Options to Improve Your Credit Score Before Applying for a Loan

- Tips for Getting Approved for a Loan with a Low Credit Score

How A Credit Score Affects Loan Eligibility

One of the biggest factors that determine loan eligibility is your credit score. A credit score is a numerical representation of your creditworthiness, and it’s what lenders use to assess your ability to repay a loan. When you apply for a loan, the lender will check your credit score to determine if you are high-risk or low-risk borrower. If your credit score is low, you may have a harder time getting approved for a loan.

For example, a credit score of 556 is considered fair but is still on the lower end of the credit score scale. A lender may be hesitant to approve a loan for someone with a 556 credit score because it indicates that the borrower has a history of delinquent payments or may have a high level of debt. If you do manage to get approved, you may have to pay a higher interest rate or put up collateral to secure the loan.

Factors That Impact Loan Approval

If you’re considering applying for a loan with a 556 credit score, it’s essential to understand the factors that could impact your approval. Although your credit score is a significant factor, lenders consider other critical factors when deciding whether to approve or decline your loan application. Here are a few factors that could affect your loan approval:

- Payment history: Lenders will look at your payment history to assess whether you’re trustworthy and likely to repay the loan. A pattern of late payments, missed payments, or defaulting on a loan can impact your chances of approval.

- Income and debt-to-income ratio: Lenders will want to see that you have enough income to pay back the loan. Your debt-to-income ratio compares your monthly debt payments to your monthly income. If you have high debt and low income, it could impact your chances of approval.

- Credit utilization: This is how much credit you’re using compared to how much is available to you. If you’re using too much credit, it could impact your credit score and your chances of approval.

Ultimately, each lender has its own criteria for approving or declining loan applications. While your credit score is a crucial factor, it’s essential to consider the other factors that could impact your chances of approval. By addressing any issues with your payment history, income, debt-to-income ratio, and credit utilization, you could improve your chances of getting approved for a loan.

Minimum Credit Score Required for Loans

Before applying for a loan, it’s essential to know the minimum credit score required. A credit score is an indicator of your creditworthiness, and most lenders use it as a deciding factor when approving loans. If your credit score is 556, it’s classified as a poor credit score and may limit your options of acquiring a loan. Most lenders require a minimum credit score of 620 or higher to grant a personal loan.

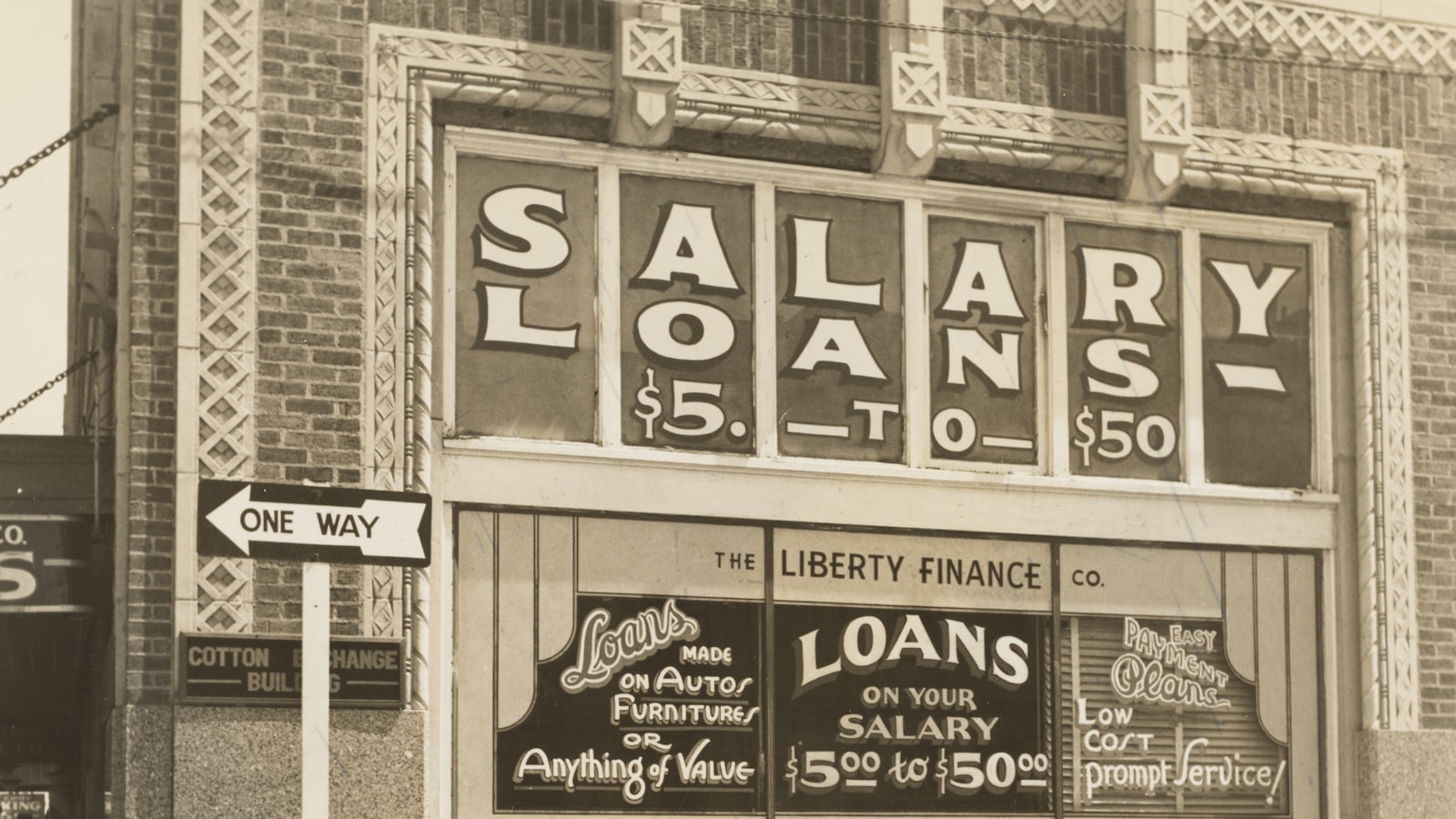

However, having a low credit score doesn’t mean that you cannot get a loan. Some lenders will still grant you a loan despite your poor credit score, but the catch is that you will get a higher interest rate. You need to compare loan offers before selecting one as some lenders have exorbitant interest rates, and you could end up paying a lot more than you intended. Alternatively, you may choose to build your credit score first before applying for a loan or consider other lending options like payday loans, which cater specifically to borrowers with poor credit scores.

Can You Qualify for a Loan with a 556 Credit Score?

If you have a 556 credit score, you may be wondering if you can qualify for a loan. The answer is yes, but the options will be limited, and you may face higher interest rates and stricter terms.

Here are a few loan options to consider:

- Payday loan: This is a short-term loan that typically needs to be repaid by your next paycheck. Payday loans often have very high interest rates and fees, so make sure you can repay the loan on time.

- Secured personal loan: If you have collateral, such as a car or savings account, you may be able to qualify for a secured personal loan. The lender will seize the collateral if you don’t repay the loan.

- Student loans: Federal student loans don’t require a credit check, so you may be able to qualify even with a 556 credit score. Private student loans may require a cosigner or higher interest rates.

Regardless of the loan you choose, make sure to read the terms and conditions carefully and compare multiple lenders to get the best rate possible.

Options to Improve Your Credit Score Before Applying for a Loan

- Pay down debt: Your debt-to-credit ratio plays a significant role in determining your credit score. Paying down your outstanding balances can help decrease this ratio and improve your score. If you can’t pay off the entire balance, try to pay more than the minimum payment each month.

- Dispute errors on your credit report: Mistakes happen, and it’s important to catch and correct them as soon as possible. If you notice any errors on your credit report, dispute them with the credit bureau to have them removed. Make sure to follow up and confirm the changes have been made.

Tips for Getting Approved for a Loan with a Low Credit Score

One of the most effective ways to secure a loan with a low credit score is to improve your credit score. Most lenders have strict requirements for credit scores, and anything lower than 580 is considered poor. Check your credit reports from the three major credit bureaus: Experian, Equifax, and TransUnion and look for any errors that may have lowered your score. Dispute any errors and pay off any debts, late payments, or collections as soon as possible. Building your credit score takes time, but it’s a vital step in getting approved for a loan.

Tip #2: Consider a Co-Signer

Another way to secure a loan with a low credit score is to find a co-signer. A co-signer is a person who agrees to take responsibility for the loan if you default on it. This can be a family member, a friend, or even a business partner who has a good credit score. With a co-signer, lenders may be more willing to approve you for a loan since they have someone else to fall back on if you’re unable to make payments. However, keep in mind that your co-signer will also be responsible for paying off the loan if you can’t.

At the end of the day, whether or not you can get a loan with a 556 credit score depends on a multitude of factors. However, don’t let your credit score discourage you from exploring your options and finding the best solution for your financial needs. With perseverance and determination, even the most challenging credit situations can be improved. Keep on track, take advantage of available resources, and remember: your credit score does not define your worth as a person or your potential for financial success.