Looking to boost your credit score? Here are 3 surefire ways to do it: First, pay your bills on time and in full each month. Second, clear or reduce your outstanding debts by consolidating them into one manageable payment. Third, keep a watchful eye on your credit report and dispute any errors or inaccuracies pronto. Follow these steps and watch your credit score soar!

- Ways to Boost Your Credit Score

- Understanding the Importance of a Good Credit Score

- How Credit Scores are Calculated

- Identifying the Factors That Affect Your Credit Score

- Three Steps to Raising Your Credit Score

- Common Myths About Credit Scores

Ways to Boost Your Credit Score

Having a good credit score is essential when it comes to getting approved for loans, mortgages, credit cards, or even for renting an apartment. Below are some ways that you can increase your credit score:

- Pay your bills on time: Late payments can negatively impact your credit score, so make sure to pay your bills on time every month. Setting up automatic payments can help you avoid missing deadlines and keep you on track.

- Keep your credit utilization low: Your credit utilization, or the amount of credit you use compared to the amount of credit you have available, is a significant factor that affects your credit score. Ideally, you should aim to use less than 30% of your available credit. For example, if you have a credit card with a limit of $10,000, try to keep your balance below $3,000.

- Monitor your credit report: Regularly monitoring your credit report can help you spot any errors or identify areas that need improvement. You’re entitled to one free credit report per year from each of the three major credit bureaus (Equifax, Experian, and TransUnion). You can request your reports at annualcreditreport.com.

By implementing these strategies, you can improve your credit score over time. Remember, it’s essential to be patient and consistent with your efforts, as it can take time to see results.

Understanding the Importance of a Good Credit Score

Having a good credit score is essential for financial stability and achieving your goals. Your credit score is a measure of your financial health. It is often used by lenders, landlords, and credit card companies to assess your creditworthiness. A good credit score makes it easier to get approved for loans, rental applications, and credit cards with low-interest rates.

- With a good credit score, you can negotiate favorable terms on loans and credit cards, such as lower interest rates and higher credit limits.

- On the other hand, a bad credit score can limit your financial options and make it difficult to get approved for loans, credit cards, and even rental applications.

- Having a good credit score is also important for achieving your long-term financial goals, such as owning a home, starting a business, or building a retirement fund.

Therefore, it is crucial to establish and maintain good credit by making timely payments, keeping your credit utilization low, and monitoring your credit report regularly. By taking steps to improve your credit score, you can achieve financial freedom and reach your goals with ease!

How Credit Scores are Calculated

Credit scores play a crucial role in determining the loans and credit limits that are available to you. Contrary to popular belief, credit scores are not calculated based on your income, savings, or debt. Instead, they are determined using a complex algorithm that analyzes your credit history. Here are some of the most important factors that are used to calculate your credit score:

- Payment history: Your payment history is the most significant factor in determining your credit score. Late payments, skipped payments, or accounts in collections can dramatically lower your score.

- Credit utilization: Your credit utilization ratio refers to the amount of credit you’re using in comparison to your overall credit limit. Ideally, you should keep your utilization ratio below 30% for the best credit score.

- Length of credit history: The longer your credit history, the better your score will be. It’s important to maintain older accounts and avoid closing them, as this can reduce the average length of your credit history.

- New credit: Opening too many new credit accounts in a short period of time can lower your score. Be sure to apply for credit only when you really need it.

- Credit mix: Having a variety of different types of credit (such as credit cards, personal loans, and student loans) can boost your score, as it demonstrates your ability to manage multiple forms of credit.

By understanding the factors that go into calculating your credit score, you can make informed choices to improve your score over time. Remember, maintaining a good credit score takes time and effort, but the rewards are well worth it in the long run.

Identifying the Factors That Affect Your Credit Score

Some of the factors that can affect your credit score include your payment history, credit utilization, and length of credit history. Your payment history is the record of how you have paid your bills over time, and it is used to determine how likely you are to pay your bills on-time in the future. If you have a history of making late payments, your credit score may be negatively impacted.

Credit utilization refers to the percentage of your available credit that you are using. If you have a credit card with a $10,000 limit and you owe $5,000, your credit utilization is 50%. In general, it is recommended that you keep your credit utilization below 30% to avoid negatively impacting your credit score. Lastly, the length of your credit history is another important factor that can affect your credit score. The longer you have been using credit, the more information there is available to determine your creditworthiness.

- Payment history: track how you pay your bills over time, avoid late payments.

- Credit utilization: keep the percentage of credit you are using below 30%.

- Length of credit history: the longer, the better.

Three Steps to Raising Your Credit Score

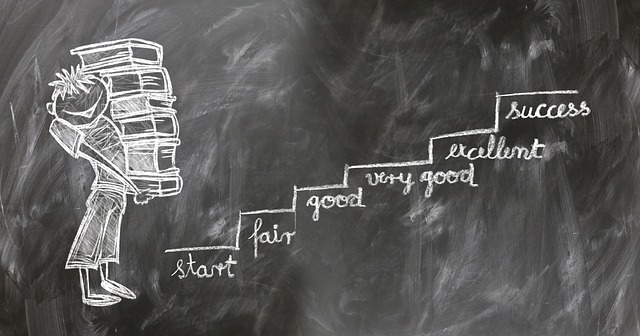

If you’re looking to increase your credit score, there are three key steps you should consider taking. These steps might seem basic, but they can have a major impact on your overall credit profile.

First, make sure you’re paying all your bills on time. This might seem obvious, but it’s worth repeating. Payment history is the most important factor in determining your credit score, so even one missed payment can have a major impact. Set up automatic payments or reminders to ensure you don’t miss any due dates.

Second, work on paying down your credit card balances. Your credit utilization rate (the amount of credit you’re using compared to your total credit limit) is the second most important factor in determining your credit score. Ideally, you want to stay below 30% utilization. If you can’t pay off your balances in full each month, focus on paying more than the minimum payment to chip away at the balance.

Finally, consider opening a new credit account. This might seem counterintuitive, but adding a new account can increase your overall available credit and improve your credit utilization rate. Just be sure not to open too many new accounts at once, as this can be a red flag to lenders.

By following these three steps, you’ll be well on your way to improving your credit score and building a stronger financial future.

Common Myths About Credit Scores

There are a lot of myths surrounding credit scores that can lead to confusion and misinformation. Here are some of the most common myths:

- Myth #1: Checking your credit score often can hurt it.

- Truth: Checking your own credit score does not hurt it. In fact, it is important to keep an eye on your score so you can make improvements if necessary.

- Myth #2: You shouldn’t use your credit card because it will hurt your score.

- Truth: Using your credit card responsibly can actually help your score. It shows that you can manage credit effectively and make payments on time.

- Myth #3: Closing credit card accounts will improve your score.

- Truth: Closing credit accounts can actually hurt your score by reducing your overall available credit and increasing your credit utilization ratio.

By understanding these myths, you can make informed decisions about your credit usage and improve your score over time.

In the end, improving your credit score doesn’t have to be a chore. Whether you choose to reduce your debt, keep your credit utilization low, or simply pay on time, taking a few small steps can yield big outcomes. So, take action today and work towards a brighter financial future!