A bad credit score is like a scarlet letter in the financial world. It’s a number that tells lenders you’re unreliable, untrustworthy, and probably not worth the risk. The lower the score, the worse it is. Think of it like an F on a report card, but instead of affecting your GPA, it affects your ability to get a loan, rent an apartment, or even land a job. So, if you’ve got a bad credit score, it’s time to roll up your sleeves and start repairing your reputation because the financial world is a tough crowd to please.

- What Is A Bad Credit Score?

- Understanding the Basics

- Factors That Affect Your Credit Score

- Consequences of Having a Poor Credit Score

- Improving Your Credit Score

- Getting Help from Credit Experts

What Is A Bad Credit Score?

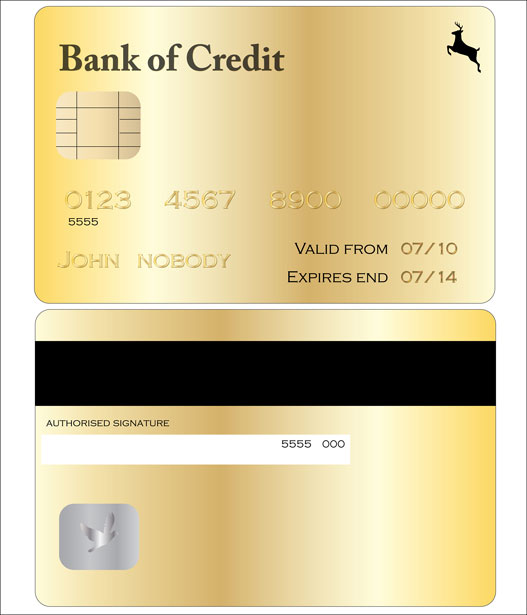

A bad credit score is a number that refers to the creditworthiness of a person. This number is calculated based on a person’s credit report and takes into consideration factors such as payment history, amount of debt owed, length of credit history, and types of credit used. This score typically ranges between 300 and 850, with a score of 300 being the lowest and 850 being the highest.

Having a bad credit score can make it difficult to obtain credit, such as a loan or credit card, and can also result in higher interest rates and fees for those who are approved. For example, someone with a poor credit score may have to pay a higher interest rate on a car loan than someone with a good credit score. Additionally, some landlords and employers may also use credit scores as a way to evaluate a person’s trustworthiness and financial responsibility.

Understanding the Basics

Before diving into the depths of bad credit scores, it’s imperative to understand some crucial basics. The credit score is a three-digit number that typically ranges between 300-850. Your creditworthiness is determined by this score, the higher the score is, the better your creditworthiness is. A good credit score is considered to be above 670, while a score below 570 is recognized as a bad credit score.

Many factors, including late payments, high credit card balances, unpaid bills, or foreclosure, can adversely affect your credit score. It’s important to note that a bad credit score may lead to undesirable consequences like higher interest rates, denial of a loan, or a higher down payment requirement to purchase a house or car. Building a good credit score by making timely payments, settling bills, and keeping a low outstanding balance can positively impact your financial future.

Factors That Affect Your Credit Score

When it comes to your credit score, there are several important factors that can have a significant impact on your creditworthiness. These factors can determine whether you have a good or bad credit score. Here are some of the most important :

- Payment History: Your payment history is the most significant factor that affects your credit score. Lenders want to see that you consistently make payments on time and don’t have any delinquencies or defaults on your record.

- Amounts Owed: The second most important factor is the amount of outstanding debt you have compared to your credit limits. If you’re using a significant amount of your available credit, it can negatively affect your credit score.

- Credit History Length: The length of your credit history is also a factor that affects your credit score. A longer credit history can be seen as a positive indication of your creditworthiness.

- New Credit: The number of recent credit applications you’ve made can also negatively affect your credit score, especially if you’ve opened several new accounts in a short period.

- Credit Mix: Finally, having a mix of different types of credit, such as credit cards, car loans, and student loans, can positively affect your credit score.

Consequences of Having a Poor Credit Score

There are serious that can extend beyond just being denied credit or loans. Here are some of the possible downsides of having a low credit score:

- Difficulty getting approved for loans and credit cards: A low credit score makes it harder to get approved for loans, credit cards, and other financial products. Even if you do get approved, you may have to pay higher interest rates, which can cost you thousands of dollars over the life of the loan.

- Limited housing options: Many landlords and property managers check credit scores when deciding whether to rent to someone. If you have a poor credit score, you may have trouble finding a place to live.

- Higher insurance premiums: Insurance companies also use credit scores when determining premiums for auto, home, and other types of insurance. People with lower credit scores typically pay higher premiums.

- Difficulty finding employment: Some employers check credit scores as part of the hiring process. While this is more common in certain industries, such as finance and the military, it can still impact your ability to get a job.

Having a poor credit score can impact your life in many ways, so it’s important to make sure you take steps to improve it as soon as possible.

Improving Your Credit Score

Improving one’s credit score can feel overwhelming, but the good news is small changes can have a significant impact. First, it’s important to identify what is pulling down the score. Is it high credit utilization or missed payments? Once identified, it’s necessary to create a plan to address these issues. One technique is to focus on paying down high credit card balances, this will lower the utilization rate and hence, the credit score will go up.

Another approach is to set up automatic payments to avoid missing due dates. Payment history is one of the most significant factors affecting credit score, having an on-time payment history creates a stable financial behavior. In addition, one can consider opening a secured credit card or becoming an authorized user on a trusted family member’s credit card account, this will establish credit history and boost the credit score.

It’s important to keep in mind that improving credit score is a gradual process. Taking an active approach to managing credit and debts is the best way to improve credit score and create financial stability. Making a commitment to this process and creating a plan are the first steps on the path to success.

Getting Help from Credit Experts

There’s no shame in seeking help from credit experts when you need it. These professionals specialize in analyzing credit reports, identifying issues affecting your credit score, and providing solutions to address those issues. Here are a few reasons you might want to consider working with a credit expert:

- Dispute errors on your credit report: Credit reports aren’t always accurate, and a credit expert can help you identify and dispute any errors that might be dragging down your score.

- Negotiate with lenders: If you’re struggling to keep up with payments, a credit expert can help you negotiate more favorable terms with your lenders, such as lower interest rates or longer repayment periods.

In short, credit experts can be a valuable resource for anyone trying to improve their credit score. Whether you’re trying to buy a house, get a new car, or simply lower your interest rates on credit cards, working with a credit expert can be a smart choice. So if you’re feeling overwhelmed or unsure where to start, don’t hesitate to reach out for help. Remember, there’s no shame in asking for assistance when you need it.

In conclusion, a bad credit score can have a significant impact on your financial well-being, limiting your access to credit, and leading to higher interest rates. Whether you have a poor credit history or are building credit from scratch, it’s crucial to take steps to improve your credit score. Remember, a good credit score is the key to unlocking better opportunities for borrowing money and achieving financial freedom.