There’s never a straightforward answer to when you should not lend money, but if any of these scenarios sound familiar, you might want to think twice: if you can’t afford to lose the money, if the borrower has a history of not repaying debts, if the request feels like emotional blackmail, or if the loan goes against your personal beliefs or values. Bottom line: lending money should always be a thoughtful decision, not a reaction to pressure or guilt-tripping.

When Lending Money Becomes a Problem

Lending money to friends or family can be a tricky situation. It’s important to determine when it’s appropriate to lend money and when it’s best to say no. The following situations may signal that lending money could become a problem:

- They have a history of not paying you back: If someone has borrowed money from you in the past and hasn’t paid you back, it’s best to not lend them any more money. It can be tempting to want to help, but it’s important to protect yourself and set boundaries.

- They have a habit of overspending: If someone you know is constantly overspending and asking for money, it may be a sign that they cannot manage their finances. Lending them money will only enable their behavior and may put you in a difficult situation later on.

- You can’t afford to lend: Even if you want to help someone, if you’re not in a stable financial situation yourself, it’s not wise to lend money. It’s essential to prioritize your own financial well-being first.

Ultimately, it’s important to remember that saying no to lending money doesn’t mean you’re being unkind or unsupportive. It’s better to create healthy boundaries and protect your financial future than to put yourself in a risky situation.

The Risks of Lending Money

There are several risks associated with lending money, and it’s imperative to be aware of them before making any decisions. These risks include:

- Default risk – when the borrower fails to repay the loan amount on time, often leading to a complete loss of the lent money. This risk is particularly high when lending to individuals with a poor credit history or those who lack financial stability.

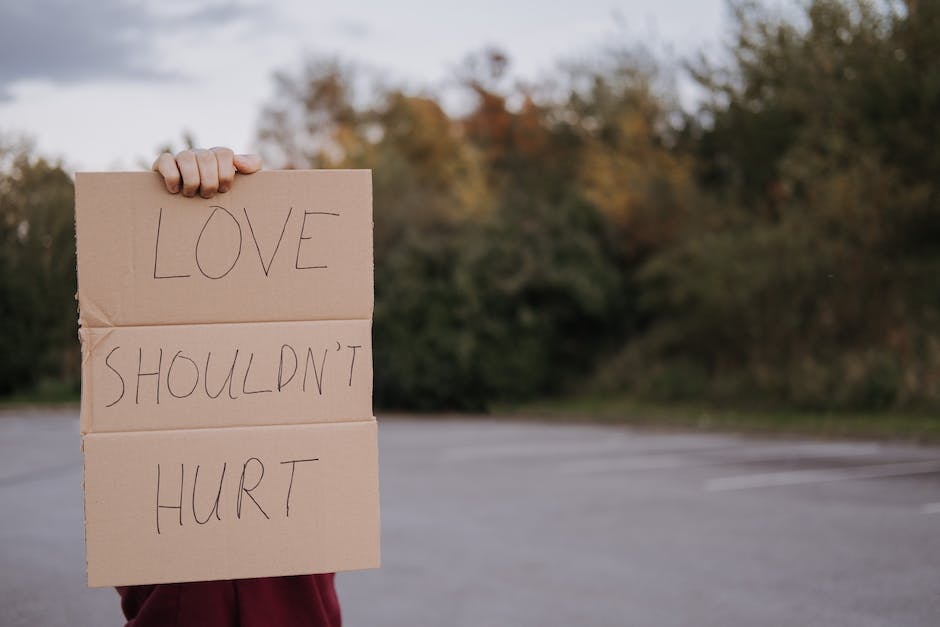

- Relationship risk – lending money to family or friends can put a strain on relationships, especially if the borrower defaults on the loan. It’s important to consider if the potential outcome is worth the potential long-term negative impact on the relationship.

- Legal risk – informal or undocumented loans can lead to legal complications if the borrower fails to repay the amount or disputes the terms of the agreement. It’s advisable to have a written agreement outlining the terms and conditions of the loan to avoid any legal entanglements.

Understanding can help you make an informed decision about whether or not to lend money. It’s crucial to weigh the potential risks against the potential benefits and consider factors like the borrower’s financial ability to repay the loan, the type of relationship you have with them, and the legal implications of the agreement.

The Consequences of Lending Money

If you lend money to someone who is not creditworthy, you may never get your money back. This can lead to a strained relationship with the borrower, making it difficult to maintain the friendship. Furthermore, lending money can create a power dynamic in the relationship; once money is involved, the borrower may feel obligated to do favors for the lender. This could lead to feelings of resentment and discomfort in the borrower, which could ultimately end the friendship.

In some cases, lending money can be illegal. For example, if the borrower is using the money for illegal activities and you are aware of it, you could be charged with aiding and abetting their crimes. Additionally, if you are charging interest on the loan and are not registered as a creditor, you could be charged with illegal lending. Therefore, it is important to be aware of the legal implications of lending money before doing so.

Reasons to Reconsider Lending Money

Consider these reasons before lending money:

- The borrower has a history of unpaid debts. This is a red flag that shows the borrower may not have the financial discipline to repay the loan. It is easy to assume that things are different this time, but history often repeats itself. If you are not willing to sacrifice your relationship with the borrower when the loan goes unpaid, it’s best not to lend money at all.

- The borrower plans to use the money for non-essential expenditure. Lending money to help someone out is one thing, but offering a loan for buying something extravagant that the borrower doesn’t need is entirely different. Ask yourself if the borrower has exhausted all other options before seeking financial assistance from you. If the answer is no, think carefully before agreeing to lend.

These are just two of many reasons why lending money might not be the best course of action. While it’s difficult to say no to people you care about, sometimes it’s crucial to do so to protect yourself and others. Always remember that you are not obliged to lend money you cannot afford to lose and that boundaries are okay to set.

When Saying No to a Request for Money is Appropriate

Sometimes, saying no to a request for money is the best thing you can do for yourself and the other person involved. Here are some situations where saying no is appropriate:

- When it will put your own finances or future plans at risk: You have to put yourself first when it comes to lending money. If giving money will bankrupt you or hinder your own financial goals, you have to politely decline. Remember that your own financial stability and future plans should not suffer because of someone else’s financial struggles.

- When it will hinder the other person’s personal growth: Sometimes, the best thing you can do for someone is to say no to their request for money. If the person is not making any effort to improve their financial situation or is not taking responsibility for their actions, it may be better not to provide money that will only enable their behavior further. It’s essential to consider if providing financial assistance will help them learn necessary life skills and wise financial habits to improve their situation in the long run or just result in temporary relief and dependence on you.

Remember that saying no can be challenging, but it’s necessary to protect your financial future and the person you’re not lending to in the long run. Think carefully and consider all relevant factors before making the final decision. Ultimately, be kind and genuinely supportive when you say no.

How to Protect Yourself When Someone Asks for a Loan

First and foremost, never lend money that you cannot afford to lose. If you have doubts about the borrower’s ability to repay the loan, do not hesitate to say no. A good rule of thumb is to only lend money if you can afford to give it away as a gift, because there’s a likelihood that you may never get it back. It is essential to set clear terms and conditions of the loan, such as payment date, interest rate, and collateral. Make sure you put everything in writing and have the borrower sign the agreement. You may also want to involve a third party, such as a lawyer or mediator, to ensure everything is legal and binding.

Furthermore, do your research on the borrower. Check their credit score, talk to their employer, and ask for references. Consider their past behavior with money and their willingness to take responsibility for their finances. If the borrower seems to have a history of bad credit and financial instability, it may be best to decline the loan. Remember, trust your instincts. If you feel uncomfortable or unsure about lending the money, it’s better to be safe than sorry. Protecting yourself from loan requests is not being selfish; it is being smart and responsible.

In the end, it’s important to remember that lending money is a personal choice and not something to be taken lightly. Whether you choose to lend or not to lend, always consider each situation on a case-by-case basis and trust your own instincts. As the saying goes, “money talks,” and so should your gut feeling.